Travel and Expense

SAP Concur Sixth Annual Global Business Travel Survey: What’s Driving Business Travel Tension and How to Address It

In its sixth year, the SAP Concur Global Business Travel Survey explores some of the most pressing challenges facing business travelers today, including the impact of travel disruptions and tighter budgets. It also revisits a few key themes from previous surveys to gauge where things stand now, including flexibility and employees’ equal opportunity to take business trips.

“The current economic environment is driving tension among business travelers, travel managers, and company leadership,” according to Charlie Sultan, president of Concur Travel at SAP Concur. “Balance between flexibility and cost is delicate, not to mention pressures from new distribution channels and ongoing geopolitical issues. This year’s report demonstrates the need for a mutual understanding of these realities and compromise in corporate travel programs.”

According to the global survey of 3,750 business travelers in 24 markets:

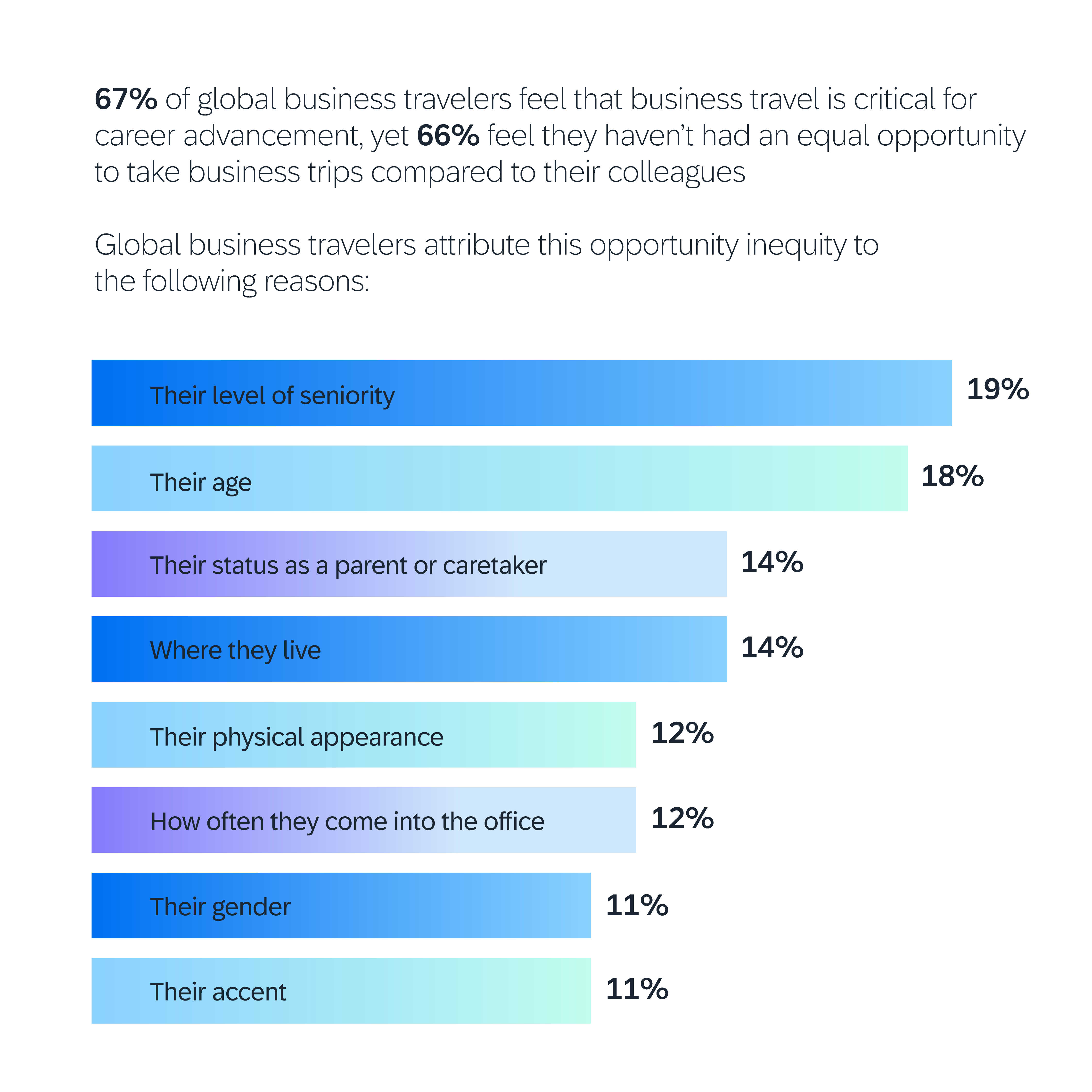

Two-thirds feel that business travel is critical for career advancement, yet just as many say they haven’t had equal opportunity to take business trips compared to their coworkers.

- More than three in four global business travelers (76%) say they enjoy business travel, and 67% feel that business travel is critical for career advancement.

- More younger travelers feel business travel is important for their career compared to older generations (Gen Z: 72%; millennial: 68%; Gen X: 64%; boomer: 58%).

- Despite this, around two in three global business travelers (66%) feel they haven’t had an equal opportunity to take business trips compared to their colleagues. That’s slightly higher than the 62% from our 2023 survey.

- Global business travelers attribute this opportunity inequity to the following reasons:

- Their level of seniority (19%).

- Their age (18%).

- Their status as a parent or caretaker (14%).

- Where they live (14%).

- Their physical appearance (12%).

- How often they come into the office (12%).

- Their gender (11%).

- Their accent (11%).

- Certain reasons are slightly more of a factor for women than men, including age (20% of women vs. 17% of men), status as a parent (17% vs. 13%), and gender (14% vs. 9%). More men say they’ve never felt that they didn’t have equal opportunity for business travel (38% vs. 29%).

- Additionally, more LGBTQ+ business travelers feel they haven’t had equal opportunity because of their physical appearance (20% vs. 12% of gen pop), disability (14% vs. 8%), and sexual orientation (20% vs. 7%).

- Global business travelers attribute this opportunity inequity to the following reasons:

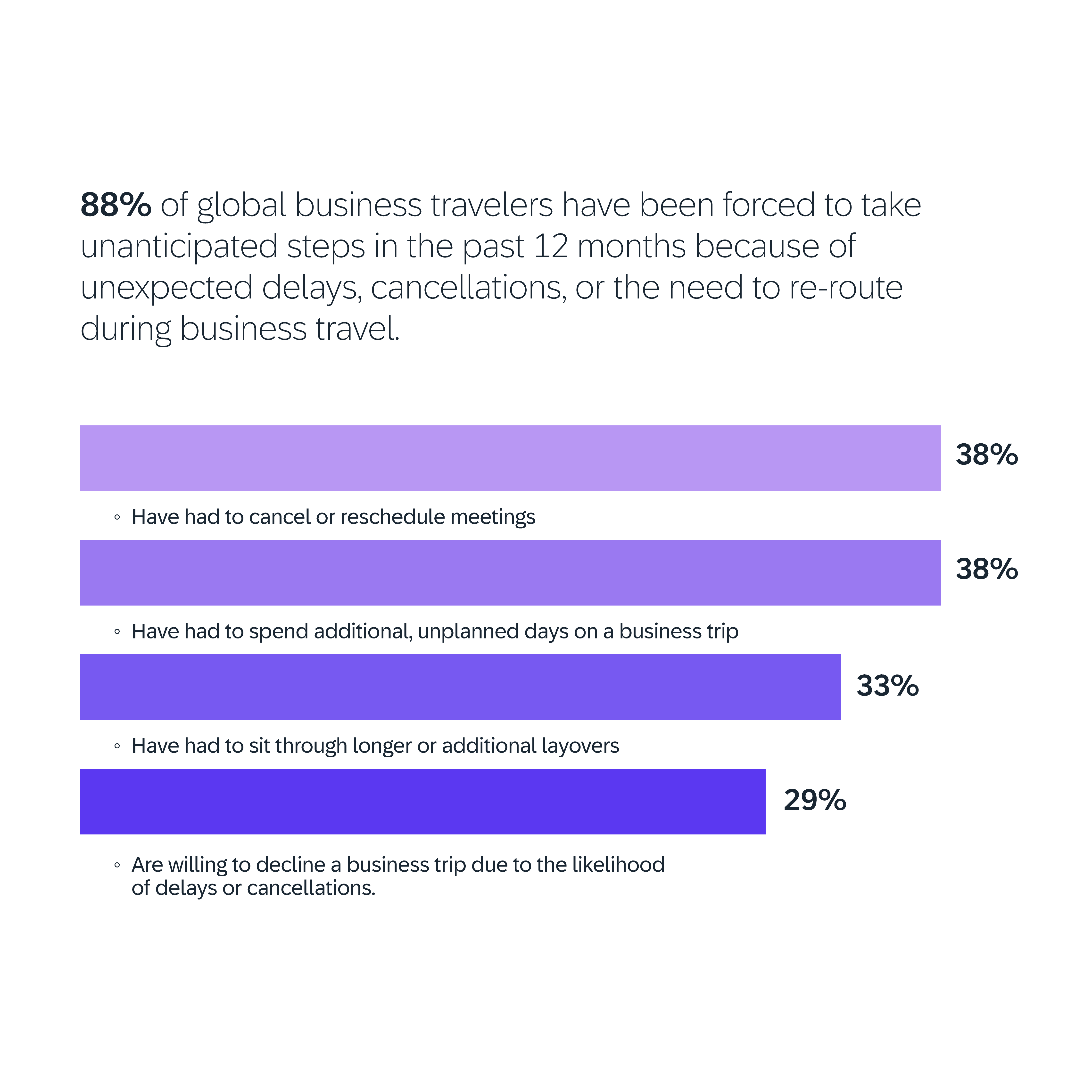

Nearly all business travelers have had to take unanticipated steps because of travel disruptions, and it’s enough to make them want to decline a business trip.

- The majority of global business travelers have been significantly impacted by travel disruptions in the past year. Nearly nine in 10 (88%) have been forced to take unanticipated steps in the past 12 months because of unexpected delays, cancellations, or the need to re-route during business travel.

- More younger travelers have been forced to take unanticipated steps (Gen Z: 94%; millennial: 90%; Gen X: 82%; boomer: 68%). Is it because older generations are business travel pros? Perhaps, but they’re also less likely to proactively build extra time into their trip (Gen Z: 80%; millennial: 83%; Gen X: 74%; boomer: 63%).

- Safety concerns are still the biggest reason that business travelers decline business trips (44%), but more than a quarter of respondents (29%) are willing to decline a business trip due to the likelihood of delays or cancellations. Thirty-three percent would also decline a trip due to safety concerns around the mode of transportation required.

- While these travel challenges are bad for business, they’re also bad for employees’ work-life balance. In addition to the nearly two in five (38%) who have had to cancel or reschedule meetings, many have had to spend additional, unplanned days on a business trip (38%) or sit through longer or additional layovers (33%).

- Travelers have had enough of losing out on their personal time and critical career connections: Four in five (80%) are proactively taking steps to account for such events, including booking extra time for arrival (34%), departure (19%), or even both (27%).

"Planning for potential disruptions can mitigate stress and ensure smoother travel experiences. Informed travelers are naturally safer because they know how to mitigate risks and find alternatives when disruptions occur,” according to Suzanne Sangiovese, director of travel and technology at Riskline, a world-class travel risk intelligence company. “Companies that invest in travel management and travel risk intelligence solutions can effectively help travelers stay updated on travel advisories and real-time destination alerts. Providing travelers with tools that can empower them to make swift, informed decisions, ensuring they can adjust plans efficiently and safely, is key."

Business travelers and travel managers struggle to exercise flexibility as company leadership cuts back on business travel costs.

- While many factors impact business travel, we asked business travelers to select their company’s top focus from three choices:

- Meeting employees’ needs for flexible travel options (40%).

- Cutting back on travel costs (31%).

- Increasing the use of sustainable travel options (29%).

- Despite business travelers saying their company is focused on their needs for flexibility, nearly all (91%) have seen their company cut back on allowing certain options in the past 12 months.

- This includes blended travel. Employees have seen cutbacks in allowing remote work while traveling for pleasure to avoid taking leave days (27%) or adding personal travel to a business trip (25%).

- And business travelers don’t love it. Around one in five (22%) say they’re willing to decline a business trip that doesn’t allow them to extend it for personal travel.

- Companies have also cut back on comfort-focused requests, such as staying overnight to avoid a long day of travel for a day trip (28%), paying more to get a non-stop flight or direct route (28%), using business or premium class (27%), or using options like taxis or ride-share apps rather than public transportation (27%).

- This includes blended travel. Employees have seen cutbacks in allowing remote work while traveling for pleasure to avoid taking leave days (27%) or adding personal travel to a business trip (25%).

- Unfortunately, travel managers are stuck in the middle. Our survey of 600 travel managers across six markets found:

- When asked what their company is most focused on:

- Though 35% say meeting employees’ needs for flexible travel options, 32% also say cutting back on business travel costs.

- Another 33% say increasing the use of sustainable travel options.

- Though 35% say meeting employees’ needs for flexible travel options, 32% also say cutting back on business travel costs.

- When asked what will make their job more difficult this year, two in five (42%) say company directives to cut travel costs amidst ongoing challenges.

- Their concern is valid, as more than a third of business travelers (36%) say they’ve incurred additional expenses on a business trip because of unexpected travel challenges, and a similar percentage (34%) have had to use an alternate transportation method. More than one in four (30%) have booked travel directly with suppliers because of unexpected travel challenges.

How to address these challenges in your corporate travel program

In addition to what experts have advised, there are a few other ways to ease the tension in corporate travel programs.

1.Connect with employees. Regularly survey employees, between and after business trips, to learn how the challenges identified in this global study impact their experience. A few questions to ask:

- Do you feel you have equal opportunity to take business trips compared to coworkers?

- What challenges have you experienced during your business trips in the past year?

- Do you feel safe when you’re traveling for business?

- Are you familiar with the company’s travel policies?

- When on a business trip, what would improve your experience or make you feel more comfortable?

- What resources are most helpful to you when booking business travel?

2. Act on employee insights. Turn the responses received from surveys into an actionable plan. Ensure that the right travel tools are in place to help employees navigate challenges. Revisit travel policies and consider what might improve their experience while booking and traveling for work.

3.Enlist the help of outside resources. Work with outside resources to facilitate employee training on things like safety and inclusion. Lean on travel management companies (TMCs) and suppliers to come up with solutions to travel disruptions.

Another resource is AI, which has the power to transform travel management. How do business travelers feel about the future of AI in travel? We asked, and we will explore the findings in our next post in this year’s SAP Concur Global Business Travel Survey series.

For more information about the survey, including additional findings, please download our business traveler, travel manager, and SMB business traveler whitepapers.

The SAP Concur Global Business Traveler Survey was conducted by Wakefield Research between April 5-26, 2024, among 3,750 business travelers in 24 markets: U.S., Canada, UK, Germany, France, Benelux (Belgium, Netherlands, Luxembourg), Sweden, Denmark, Norway, Finland, Italy, Spain, ANZ (Australia, New Zealand), Middle East (UAE, Saudi Arabia), Japan, Korea, India, Mexico, Brazil, SEA (Singapore, Malaysia), South Africa, Portugal, Switzerland, and Austria.

The SAP Concur Global Travel Manager Survey was conducted by Wakefield Research between April 5-26, 2024, 2024, among 600 travel managers, defined as those who direct or administer travel programs for businesses, across 6 markets: Germany, Canada, Japan, ANZ Countries (Australia and New Zealand), UK, and U.S.