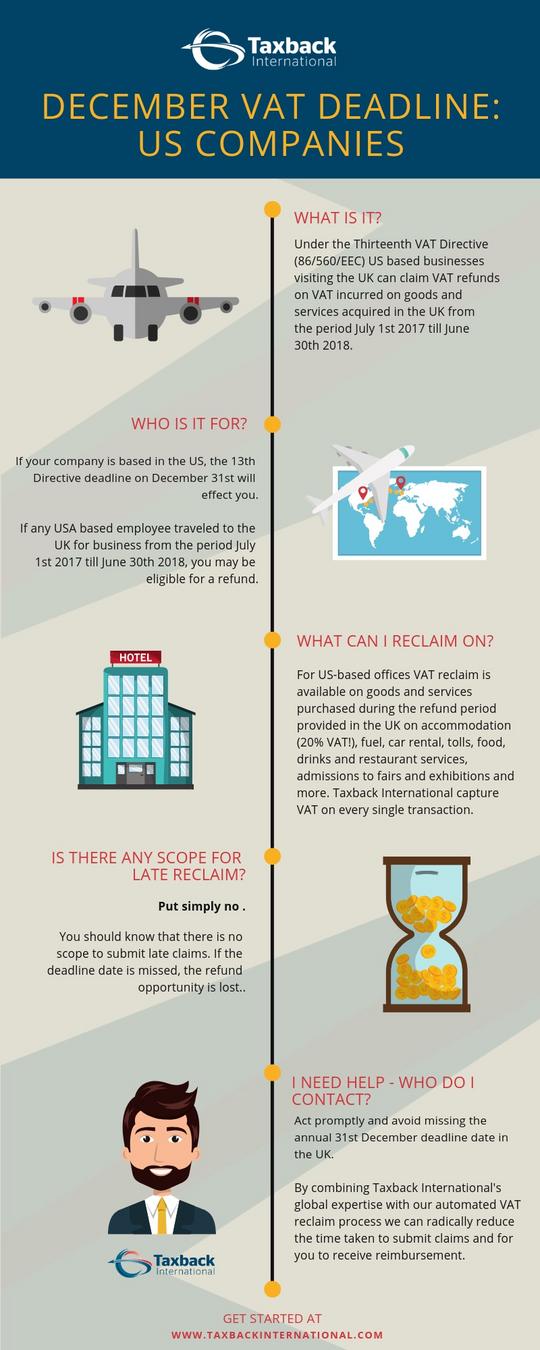

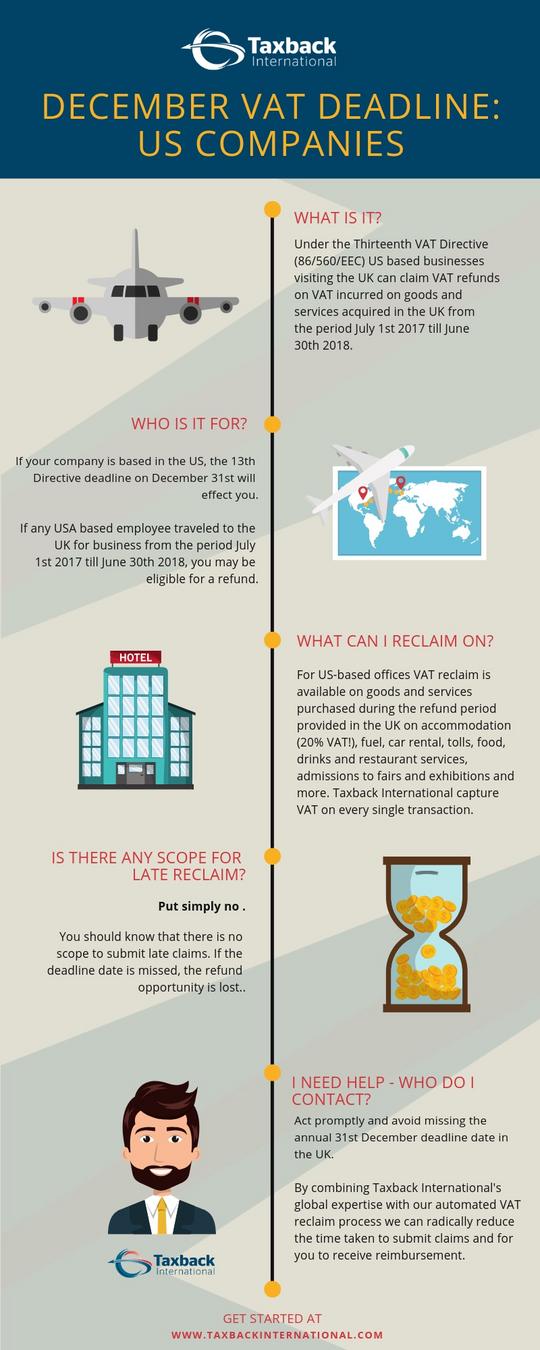

December VAT Deadline for U.S. Companies: Are You Ready?

Did your employees travel to the UK and incur business related expenses between July 1, 2017 and June 20, 2018?

Under the 13th VAT Directive, the deadline for Non-EU countries reclaiming VAT from travel to the UK is December, 31 2018. There is no scope for late returns, so if you miss the deadline you lose your refund!

Check out this infographic from SAP Concur App Center partner Taxback International to see if you are due a VAT refund from the UK.

To learn more about VAT recovery, take a look at the success AEG Worldwide experienced by reclaiming VAT with SAP Concur and Taxback International.